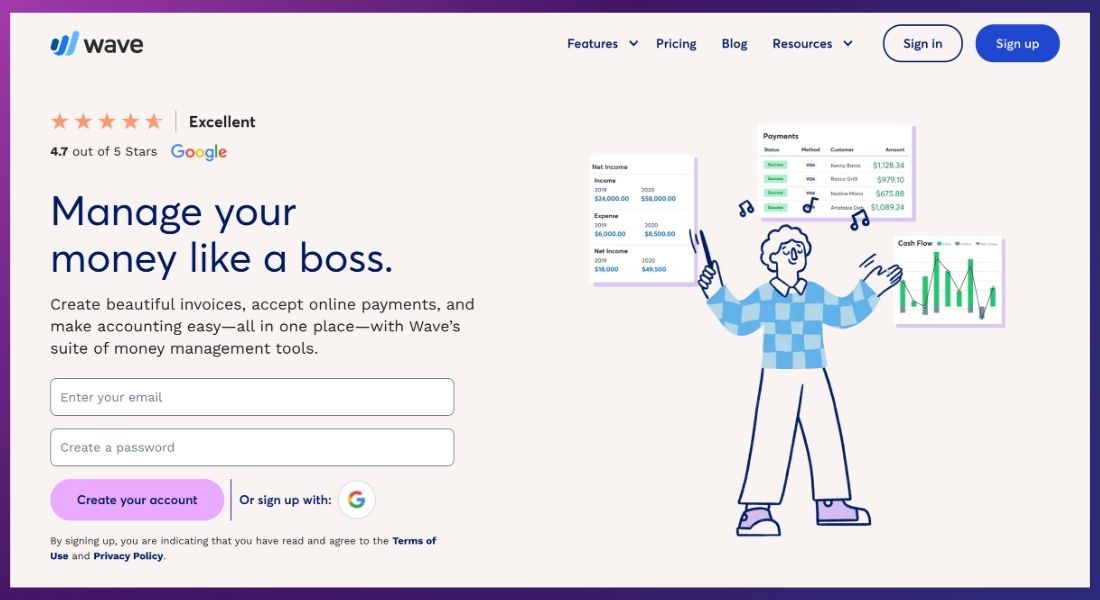

WaveApps

Managing a small business frequently requires balancing a number of responsibilities, such as accounting, customer service, and marketing. While larger businesses can hire teams to manage these aspects, smaller ones need practical tools to help streamline tasks. WaveApps has emerged as a go-to solution for accounting and bookkeeping, especially for those looking for a free, easy-to-use tool.

In this post, we’ll dive deep into Bookkeeping with WaveApps, exploring its features, pros, cons, pricing structure, and how it compares to other tools in the market. Whether new to WaveApps or looking to switch your bookkeeping platform, this guide will give you everything you need to know.

Key Features of WaveApps

WaveApps offers a range of features tailored to the needs of small businesses and freelancers. Here are the primary ones:

Accounting

WaveApps excels in providing a straightforward accounting system. It offers:

- Income and Expense Tracking: Link your credit cards and bank accounts to receive smooth transaction notifications and keep an eye on your money in real time.

- Double-Entry Accounting: A system used by professional accountants to ensure accuracy and accountability.

- Tax Preparation: WaveApps makes it easy to categorize expenses, preparing you for tax season.

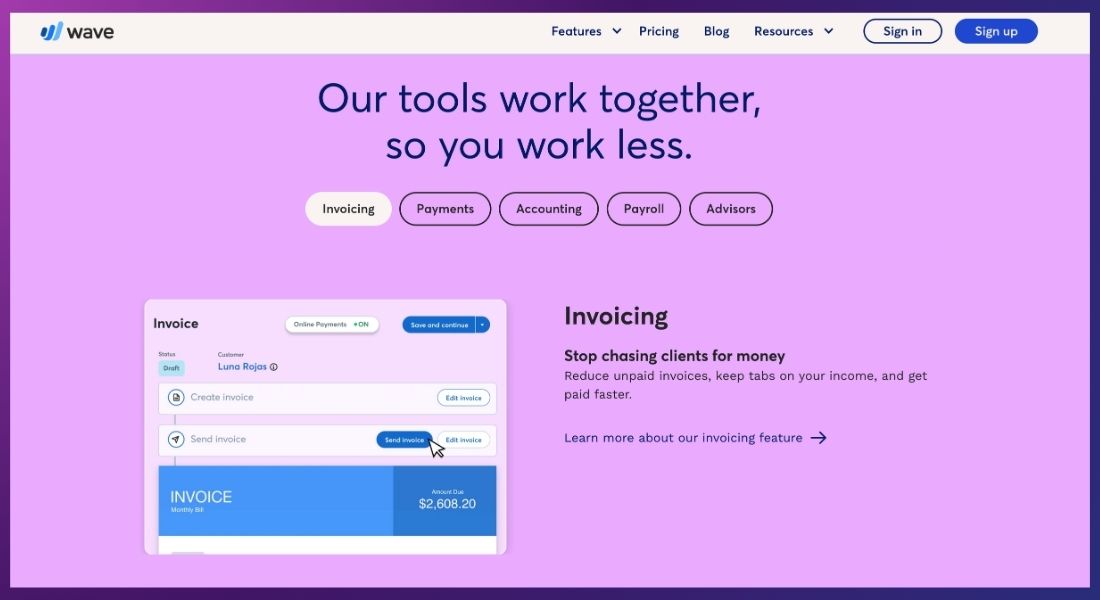

Invoicing

WaveApps allows you to create professional invoices effortlessly. Some features include:

- Customizable Invoice Templates: Tailor invoices to your brand, making your business look more polished and professional.

- Recurring Invoices: Create automated reminders for overdue bills and set up recurring invoices for your regular clients.

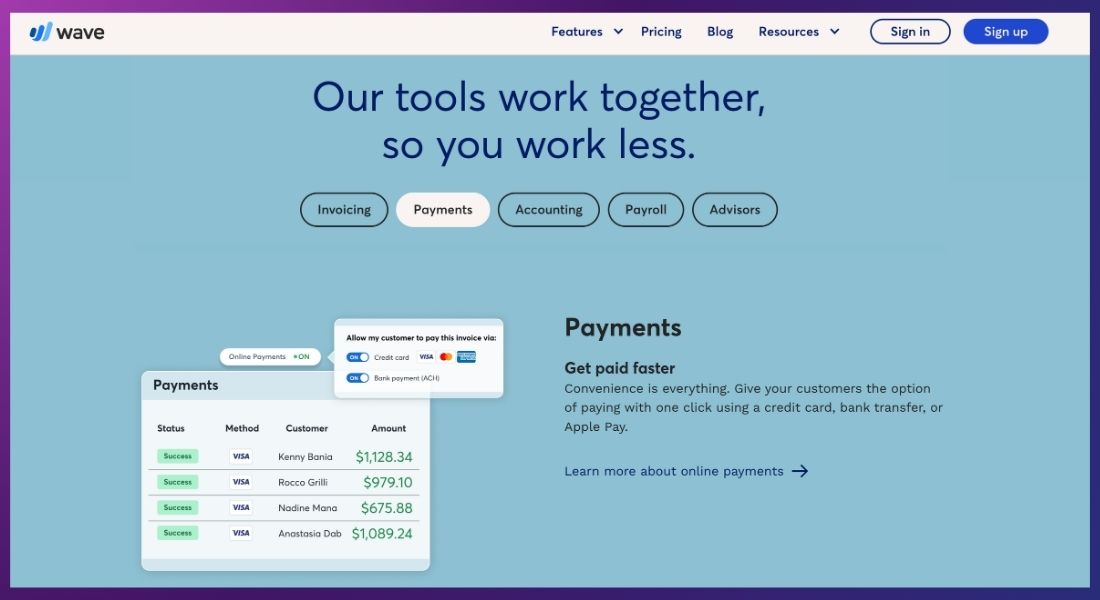

- Payments: Accept payments directly through the invoices, including credit cards and ACH transfers.

Expense Tracking

With Wave’s mobile app, expense tracking is easy and accessible. You can:

- Snap and Store Receipts: Take a picture of your receipt, and Wave will log the expense automatically.

- Categorize Expenses: Use auto-categorization or manually organize your expenses to match your bookkeeping preferences.

Payroll

WaveApps offers payroll services that streamline paying employees. It includes:

- Direct Deposit: Directly deposit salaries to your employees’ bank accounts.

- Tax Filings: Automatic tax filings for businesses in the U.S. and Canada, saving you time and reducing errors.

- Payroll Calculations: Automatically calculate wages, deductions, and taxes for each pay period.

Benefits of Using WaveApps for Bookkeeping

When it comes to small businesses and freelancers, there are several compelling reasons to use WaveApps:

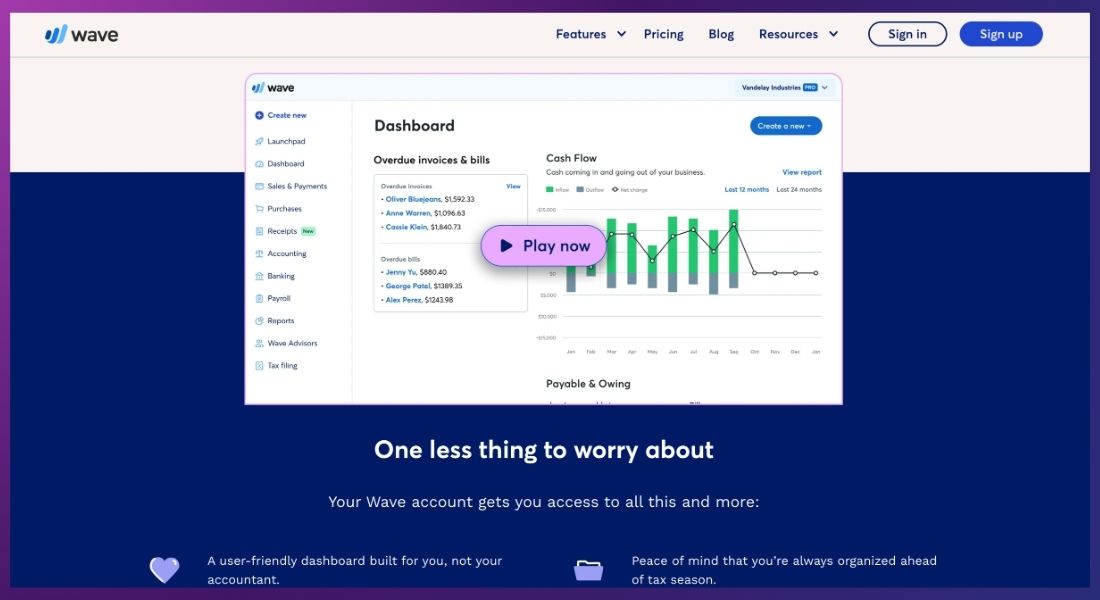

User-Friendly Interface

One of the standout features of WaveApps is its ease of use. Designed for non-accountants, Wave offers an intuitive dashboard where you can track your financials at a glance.

Free Forever Plan

Unlike many competitors, Wave offers essential bookkeeping tools entirely free of charge. This includes features like invoicing, expense tracking, and basic accounting. The free plan is perfect for freelancers or small businesses who want to avoid paying for accounting software.

Cloud-Based and Secure

WaveApps is cloud-based, meaning you can access your financial data from anywhere, whether you’re in the office or on the go. Security is also a top priority with encryption, two-factor authentication, and regular backups ensuring your data stays safe.

Pricing Structure of WaveApps

While most of Wave’s features are free, there are paid options for businesses needing additional services like payments and payroll.

Free Plan

Wave’s Free Plan includes:

- Accounting Features: All the essential tools needed for basic bookkeeping.

- Invoicing & Receipt Scanning: Includes unlimited invoicing and receipt scanning features.

Paid Add-Ons

WaveApps provides additional services as add-ons for businesses that need more advanced functionality.

- Wave Payments: This feature allows businesses to accept online payments. The processing fee is 2.9% + 30¢ 1% for bank payments (ACH) and one percent for credit card transactions .

- Payroll Services: Payroll services start at $35 per month + $6 per active employee for businesses in the U.S. and Canada.

Pros and Cons of Bookkeeping with WaveApps

Pros

- Completely Free: WaveApps offers a powerful accounting platform at no cost for basic bookkeeping.

- Easy to Use: Its user-friendly interface makes it accessible for non-accountants.

- Built-in Payments and Payroll: The integration of payments and payroll features eliminates the need for third-party apps.

Cons

- Limited to Small Businesses: Larger businesses or those with more complex accounting needs may find WaveApps lacks the advanced features needed for more extensive financial management.

- Limited International Payroll Support: Payroll services are only available in the U.S. and Canada.

- No Inventory Management: If you need inventory tracking, Wave does not offer this feature, making it less suitable for product-based businesses.

Getting Started with WaveApps

Here’s a quick guide to get you started with WaveApps:

Step 1: Sign Up

WaveApps offers a straightforward sign-up process. You only need an email and some basic business information to create an account.

Step 2: Connect Your Bank Accounts

You can automatically import transactions by linking your bank accounts and credit cards once your profile has been setup.

Step 3: Create Invoices and Track Expenses

Start generating invoices using Wave’s customizable templates. You can also scan and log expenses using the mobile app.

Step 4: Set Up Payroll (If Needed)

If you have employees, Wave’s payroll services can automate your payment process. You’ll need to input employee details and bank information.

Alternatives to WaveApps

While WaveApps is excellent for small businesses and freelancers, it’s not the only bookkeeping tool out there. Here are some alternatives:

QuickBooks Online

QuickBooks offers a more comprehensive solution for businesses needing advanced features like inventory tracking, budgeting, and more robust reporting tools. However, it comes with a monthly fee starting at $25.

FreshBooks

FreshBooks is primarily designed for invoicing but has expanded into basic accounting. It offers a more user-friendly interface for invoicing but lacks some of the deeper accounting features offered by Wave.

Zoho Books

Zoho Books is an affordable alternative with a full suite of accounting tools. It’s perfect for businesses that want a middle ground between Wave’s simplicity and QuickBooks’ advanced features.

Final Thoughts on Bookkeeping with WaveApps

WaveApps is a powerful, free solution for freelancers, small businesses, and solopreneurs looking for a simple yet effective way to manage their finances. It is among the greatest free solutions on the market right now because of its extensive feature set and easy-to-use layout. While it has some limitations, particularly for larger businesses, the combination of free accounting tools and paid add-ons makes WaveApps a highly versatile option for most small business owners.

GALLERY

Featured image represents the contents