QuickBooks

Managing finances can be pain, especially for small business owners and freelancers. QuickBooks, a powerful bookkeeping software, has been designed to simplify this process. With its wide array of features, it not only automates repetitive accounting tasks but also provides insights into your financial health, making it the go-to solution for many. But is QuickBooks the best bookkeeping software for your business? Let’s explain its features, pros, cons, and pricing structure to help you decide.

What is QuickBooks?

QuickBooks is a comprehensive bookkeeping program designed to satisfy small and medium-sized business needs. Launched by Intuit, QuickBooks offers cloud-based and desktop accounting tools that allow users to manage their finances, track expenses, send invoices, handle payroll, and even prepare for tax season. It has evolved over the years into a full-service platform used by millions worldwide.

Key Features of QuickBooks

Automated Invoicing and Payments

One of the most vital aspects of QuickBooks is its automated invoicing system. The software lets you generate customized invoices that reflect your brand, send them to clients automatically, and keep track of who has paid and who hasn't.

- Customizable Invoices: Tailor your invoices to suit your brand’s style.

- Automated Reminders: The system will automatically remind clients of unpaid invoices.

- Payment Integrations: Accept online payments seamlessly via integrations with PayPal, credit cards, and other payment systems.

Bank Reconciliation Made Easy

QuickBooks automatically syncs with your bank account, simplifying the reconciliation process by matching transactions from your bank with those recorded in QuickBooks.

- Automatic Syncing: No need to manually input transactions.

- Match Transactions: Easily match transactions, spot discrepancies, and resolve them quickly.

Payroll Integration

QuickBooks provides full-service payroll management that includes tax calculation, employee payments, and even the filing of tax forms.

- Automated Payroll: Save time by automating payroll processing.

- Tax Filing: QuickBooks will handle tax filings for you.

- Employee Time Tracking: Track employee hours and incorporate them into your payroll.

Expense Management

QuickBooks makes it easy to categorize and track all your business expenses. With the ability to upload and manage receipts, QuickBooks ensures you’re always on top of your spending.

- Receipt Management: Upload and organize receipts digitally.

- Real-time Dashboards: Monitor business expenses in real time.

Financial Reporting and Tax Filing

One of the most valuable features of QuickBooks is its reporting capability. Generate profit & loss statements, balance sheets, and cash flow reports effortlessly. Additionally, the platform is designed to simplify tax filing with tools that ensure accuracy and compliance.

- Detailed Reports: Generate critical financial reports.

- Tax Preparation: Get audit trails and tax summaries to ensure compliance.

Pros and Cons of QuickBooks

Pros

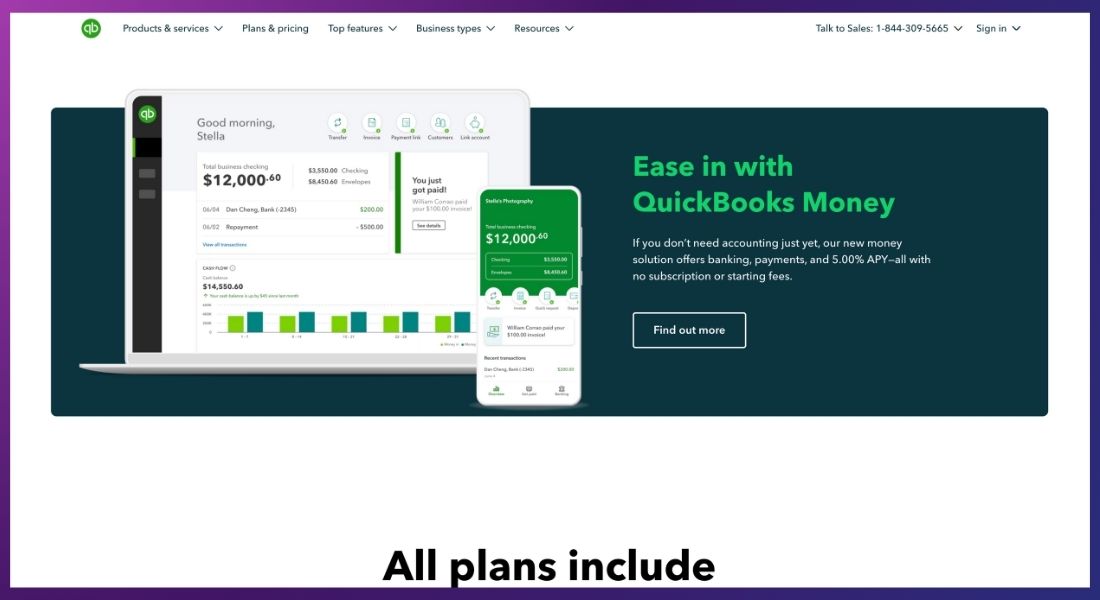

- User-Friendly Interface: QuickBooks has an easy-to-use dashboard, making it accessible even for non-accountants.

- Comprehensive Features: Everything from payroll to tax filing is included in one platform.

- Automation: Reduces manual entry through bank feeds, automated invoicing, and payroll.

- Scalable Plans: Offers a range of pricing tiers for businesses of different sizes.

Cons

- Costly for Small Businesses: Monthly subscription costs can add up, especially for small businesses on tight budgets.

- Learning Curve for Advanced Features: It could take some time to get proficient with some of the more intricate aspects.

- Syncing Issues: Occasional issues syncing with banks, which may cause delays in transaction updates.

- Limited Features in Lower-Tier Plans: Some useful features like inventory management or project tracking are only available in higher-tier plans.

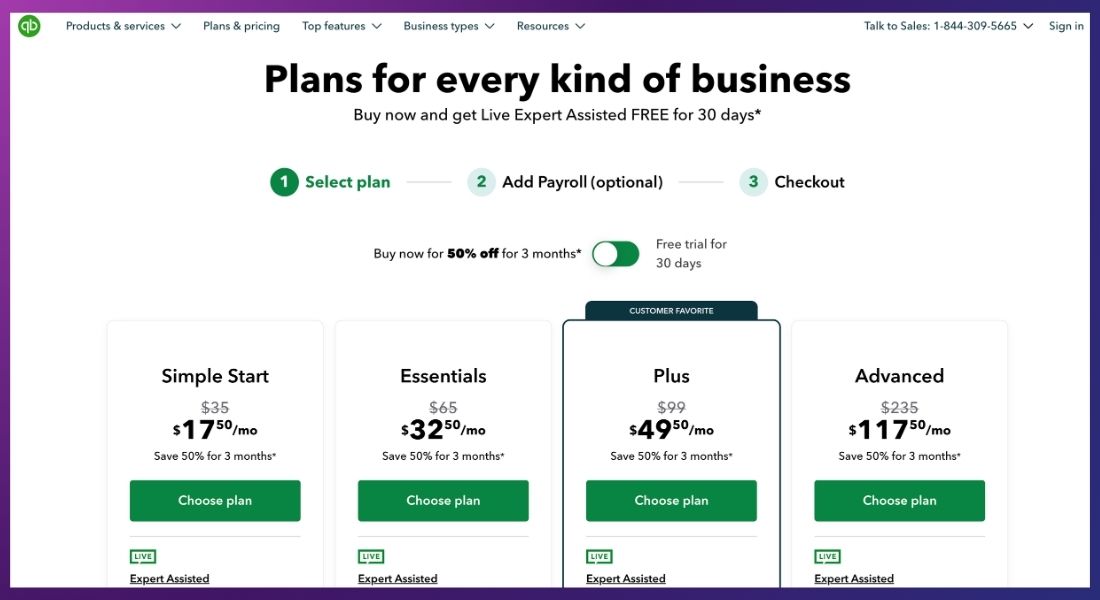

QuickBooks Pricing Structure

QuickBooks provides a range of price options to meet various business requirements:

- QuickBooks Self-Employed: Priced at $15/month, this plan is ideal for freelancers who need basic bookkeeping functions.

- QuickBooks Simple Start: At $25/month, this plan suits small businesses that need invoicing and expense tracking features.

- QuickBooks Essentials: At $50/month, Essentials adds bill management and time tracking.

- QuickBooks Plus: Available at $80/month, Plus includes project tracking and inventory management.

- QuickBooks Advanced: For larger businesses, the Advanced plan starts at $180/month and offers more robust reporting tools and dedicated support.

External Resource: Learn more about QuickBooks plans here.

Alternatives to QuickBooks

If you're exploring other bookkeeping software, here are some great alternatives:

Xero

Xero is a cloud-based accounting software often compared to QuickBooks for its ease of use and affordability. It’s great for small businesses that need real-time tracking of transactions and integrates with over 800 third-party apps.

FreshBooks

FreshBooks is best for freelancers and small business owners who focus primarily on invoicing. Its intuitive interface and automated follow-ups make it stand out for service-based businesses.

Wave Accounting

For businesses looking for a free solution, Wave Accounting is an excellent choice. It offers free invoicing, accounting, and receipt scanning, making it ideal for freelancers and very small businesses.

Is QuickBooks the Best Bookkeeping Software for Your Business?

QuickBooks remains one of the best bookkeeping software options for small to medium-sized businesses. Its wide range of features, from payroll management to tax filing, makes it a one-stop solution for businesses trying to simplify their financial processes. However, if cost is a concern or you only need basic features, there are alternatives worth considering.

GALLERY

Featured image represents the contents