AltIndex AI

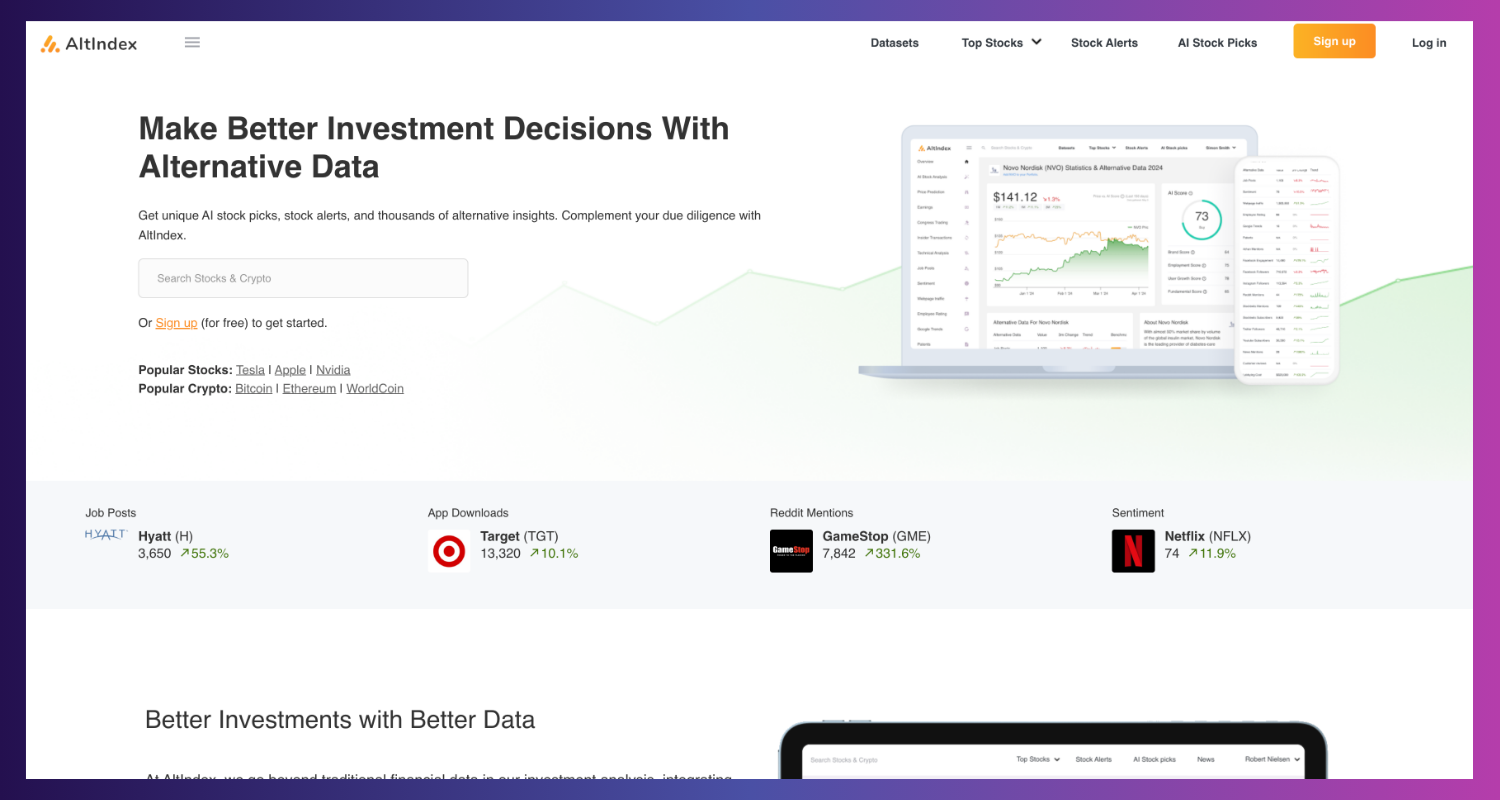

The stock market is no longer just about earnings reports and quarterly filings. In 2025, investors are increasingly turning to alternative data — everything from app downloads and web traffic to social media buzz — to spot trends before Wall Street catches on.

AltIndex is one of the rising platforms in this space, promising to blend AI stock picks with alternative data signals. But does it deliver real value, or is it another overhyped AI investing tool?

In this review, we’ll cover what AltIndex is, how it works, its features, pros and cons, pricing, and how it compares to alternatives. By the end, you’ll know if AltIndex deserves a place in your investing toolbox.

What is AltIndex?

AltIndex is a market intelligence platform that helps investors analyze companies using AI-driven stock picks and alternative data insights. Instead of relying solely on traditional fundamentals, it incorporates signals such as:

- Job postings from hiring sites

- Website traffic trends

- App store rankings & downloads

- Social media sentiment and buzz

- News trends

This multi-layered approach aims to give users an edge by spotting patterns before they show up in earnings reports or analyst upgrades.

In short: AltIndex tries to connect the dots between real-world activity and stock performance.

How AltIndex Works: Alternative Data & AI

AltIndex combines data collection, AI modeling, and dashboards into a single platform.

- Data Collection

- AltIndex pulls from dozens of public and semi-public sources, including LinkedIn job postings, SimilarWeb traffic stats, Twitter/Reddit sentiment, and app usage.

- AI Modeling

- The platform’s algorithms analyze this data for leading indicators. For example, if a company is suddenly hiring aggressively for AI engineers, or if their app ranks jump in multiple regions, that could be bullish.

- Stock Picks & Alerts

- AI models generate lists of “AI stock picks,” highlighting companies expected to outperform. Users can also set alerts to track sudden spikes in data.

- Dashboards & Visuals

- AltIndex provides clean dashboards showing signals, trends, and stock ratings, making it easier to digest large amounts of data.

Key Features & Tools

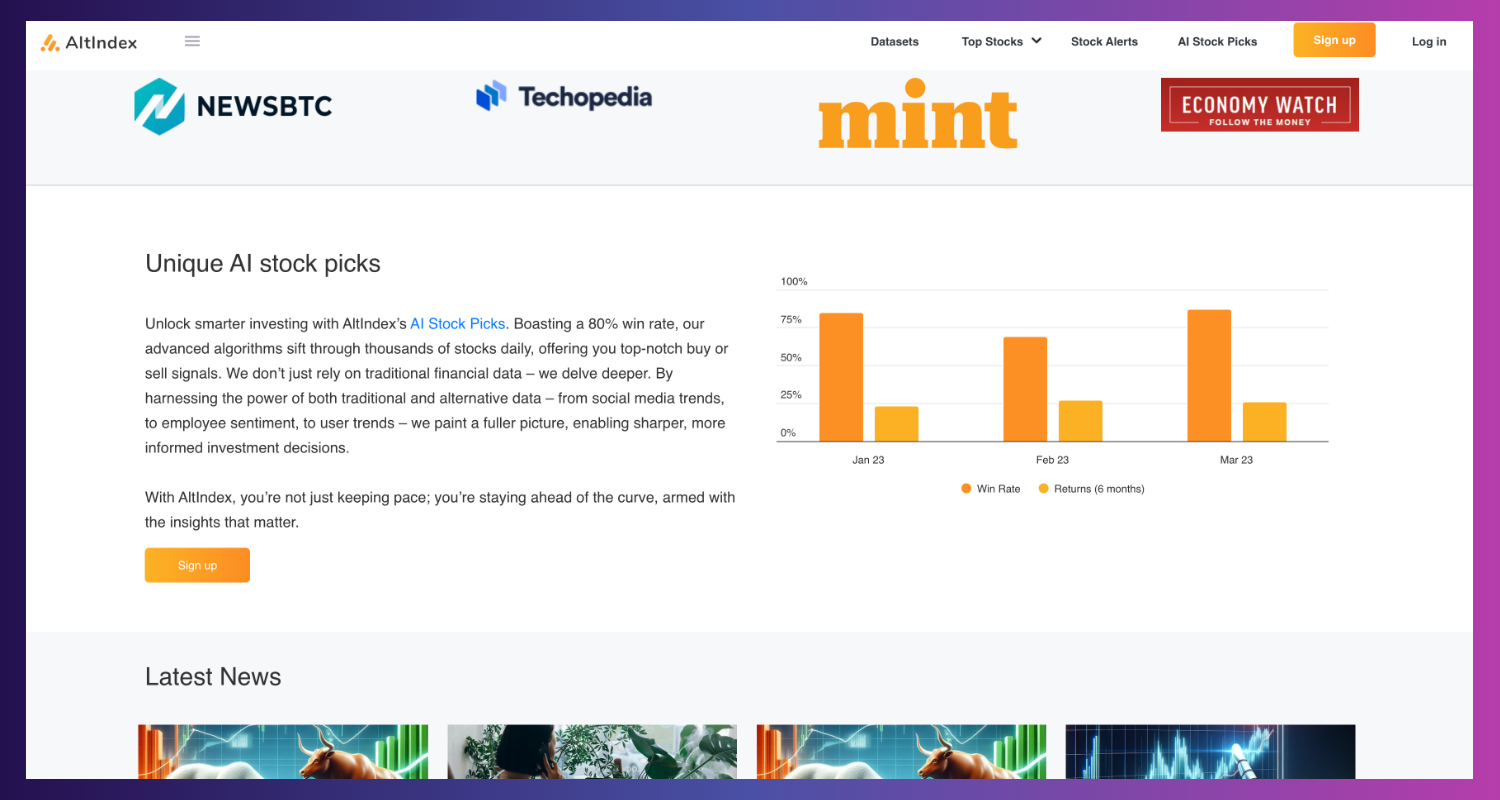

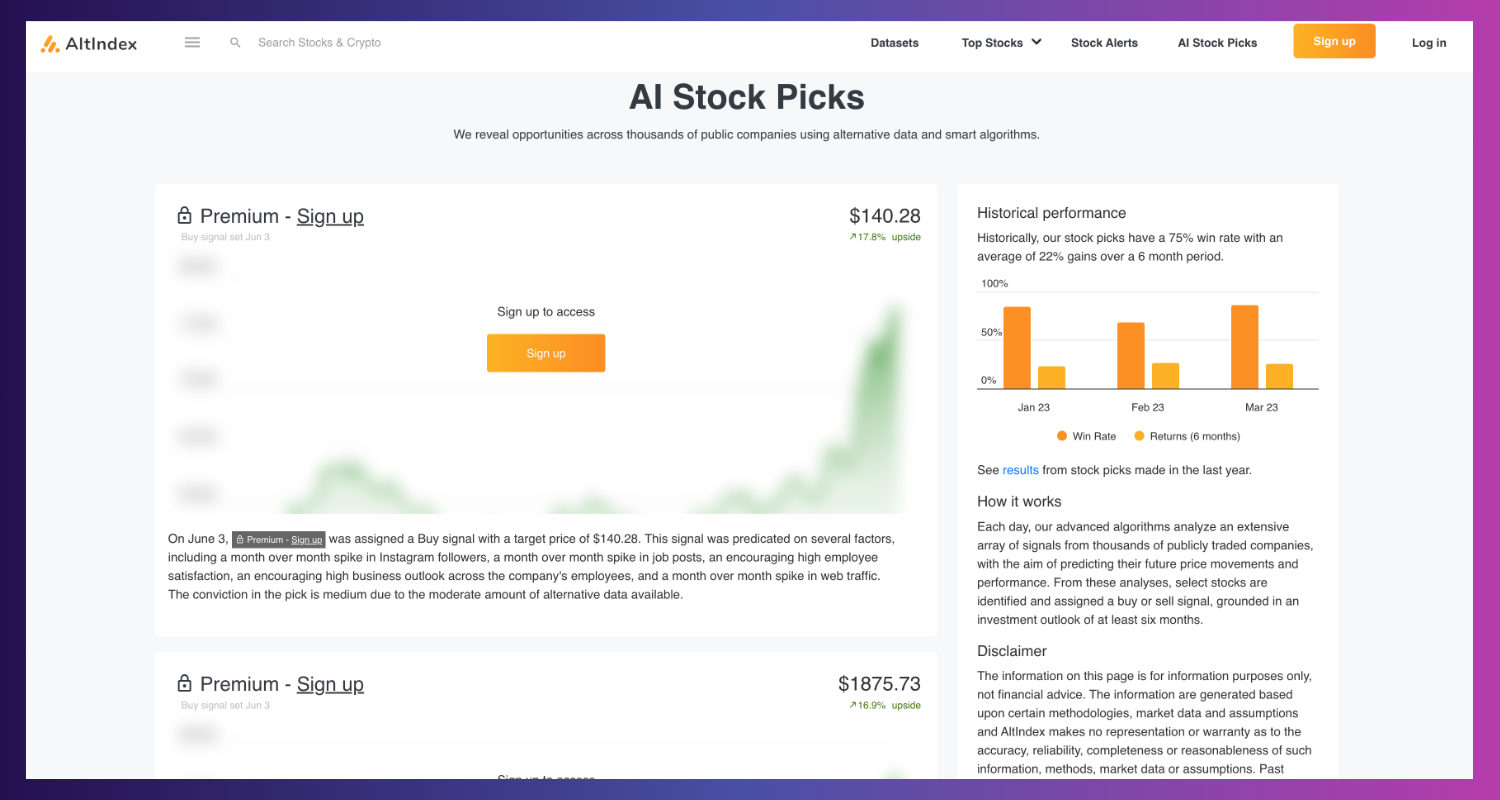

AI Stock Picks

The most marketed feature is AltIndex’s AI-powered stock recommendations, claiming win rates of up to 80%. These are generated by algorithms that weigh alternative data factors alongside market movements.

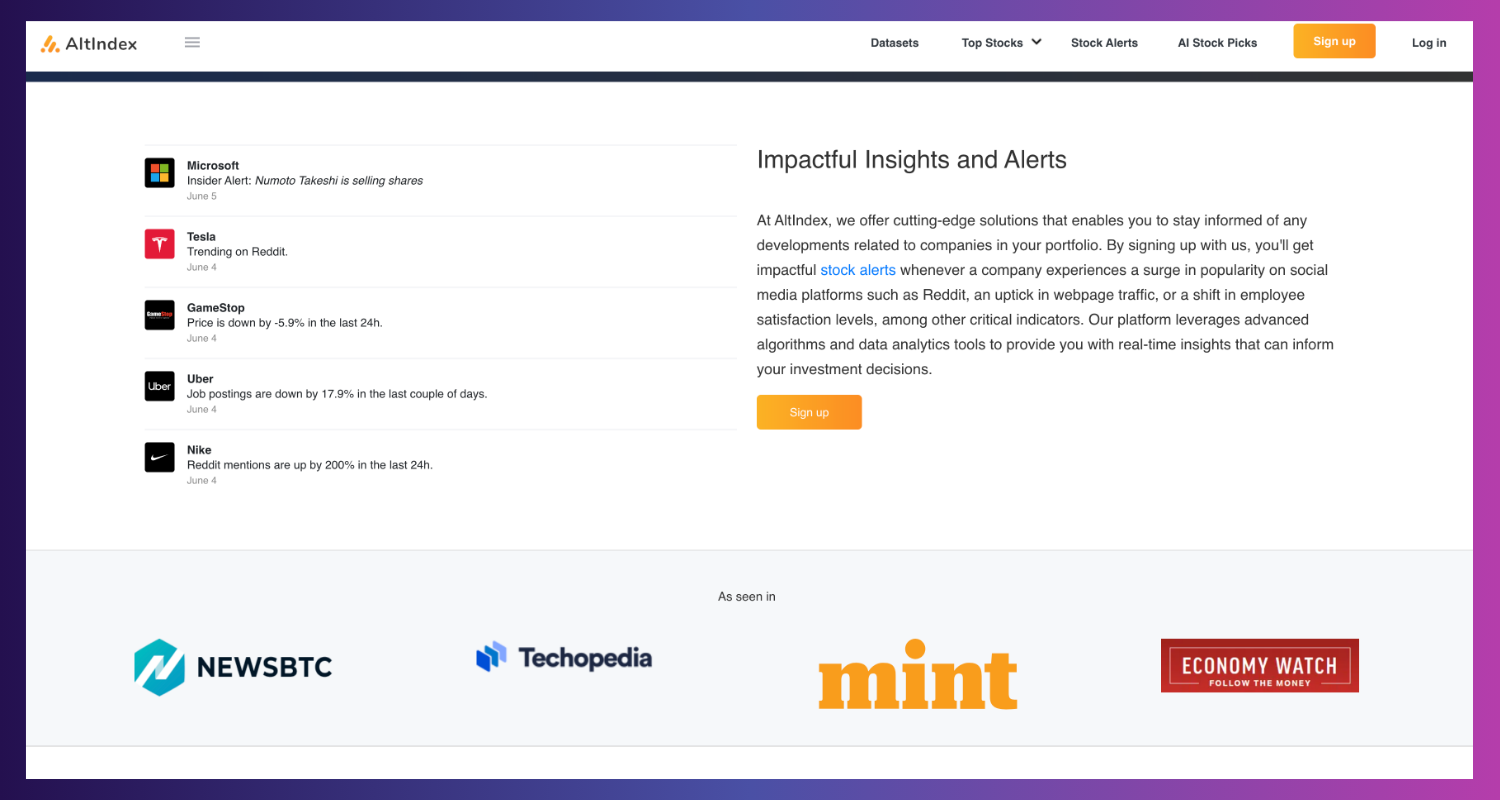

Real-Time Alerts

Users can set alerts for changes in social sentiment, job postings, or app activity. For active traders, this can be a powerful way to react quickly.

Alternative Data Dashboard

The dashboard highlights trending stocks, top data shifts, and notable sentiment changes. It’s designed to give you at-a-glance intelligence without drowning in raw data.

Social Media Analytics

AltIndex tracks buzz across platforms like Reddit, X (Twitter), and TikTok, attempting to quantify investor sentiment. For meme-stock watchers, this is invaluable.

Multi-Source Integration

Instead of being locked into financial data only, AltIndex blends signals across sources — creating a “360-degree” picture of companies.

User Experience & Interface

One of AltIndex’s strengths is its simplicity. The dashboard is designed to be beginner-friendly, even if you’re new to alternative data.

- Navigation: The layout is clean, with tabs for stock picks, alerts, and data visualizations.

- Speed: Pages load fast, though real-time alerts sometimes lag by a few minutes.

- Clarity: Data is presented visually, making it easier to interpret trends without an analyst background.

However, some users report data overload — there’s so much information that beginners might struggle to decide which signals actually matter.

Pros of AltIndex

- ✅ Unique data sources — goes beyond financial statements into real-world signals.

- ✅ AI stock picks with clear win/loss tracking.

- ✅ Real-time alerts help traders act on trends quickly.

- ✅ User-friendly dashboards — easier to digest than raw spreadsheets.

- ✅ Affordable entry plan starting around $29/month.

- ✅ Good for both traders and long-term investors who want an extra edge.

Cons & Risks

- ❌ Mixed trust ratings — AltIndex scores 3.0/5.0 on Trustpilot, with feedback ranging from positive to skeptical.

- ❌ Still a young platform — not as established as Bloomberg or FactSet.

- ❌ Marketing claims (80% win rate) lack independent validation.

- ❌ Risk of overreliance on alternative data — signals can be noisy or misleading.

- ❌ Subscription costs add up if you scale to premium plans.

- ❌ Data overload for beginners — too many signals can confuse inexperienced users.

Pricing & Subscription Plans

AltIndex uses a subscription model with multiple tiers.

- Basic Plan (~$29/month): AI stock picks, dashboards, and limited alerts.

- Pro Plan (~$99/month): Full access to alerts, advanced analytics, more data sources.

- Enterprise (custom pricing): For funds or institutions needing deeper integration.

Compared to Bloomberg Terminal ($2,000+/month), AltIndex is far more affordable, but it’s aimed at a different audience — traders and investors who want signal-based insights without enterprise costs.

AltIndex vs Alternatives

AltIndex vs Bloomberg Terminal

- Bloomberg offers real-time market data and trading tools, but at a massive cost.

- AltIndex focuses on alternative data signals, offering insights Bloomberg often misses.

AltIndex vs FactSet

- FactSet is more quant-heavy, while AltIndex leans on alternative data and sentiment.

- AltIndex is cheaper but less proven.

AltIndex vs Quiver Quant

- Quiver Quant is another alternative data tool, tracking government trades, lobbying, and more.

- AltIndex overlaps but emphasizes AI-driven picks and broader datasets.

Verdict: AltIndex is best as a complementary tool rather than a Bloomberg replacement.

Who Should Use AltIndex?

AltIndex is ideal for:

- Active traders looking for sentiment-driven alerts.

- Retail investors who want to test AI stock picks.

- Analysts interested in alternative data signals.

- Hedge funds & small firms that can’t afford Bloomberg but want edge data.

It’s less ideal for:

- Investors who prefer fundamentals only.

- Complete beginners with no trading knowledge.

- Firms needing guaranteed accuracy and uptime.

Final Verdict & Recommendation

So, is AltIndex worth using in 2025?

Yes — if you’re curious about alternative data and want affordable access.

AltIndex delivers a unique mix of AI stock picks, sentiment analysis, and non-traditional signals at a fraction of the cost of enterprise platforms. It’s not perfect — user reviews are mixed, and claims about win rates should be taken with caution.

But as a complementary investing tool, it can help you spot opportunities earlier than traditional research.

Bottom line: If you’re willing to experiment and don’t mind some noise in the signals, AltIndex is worth trying — especially on the entry plan.

FAQ – Frequently Asked Questions

1. Is AltIndex free?

No. Plans start at around $29/month, with higher tiers offering more data and alerts.

2. Is AltIndex legit?

Yes, it’s a real company, but user reviews are mixed. It’s best for supplementing traditional analysis.

3. Can AltIndex replace Bloomberg or FactSet?

No. It’s a complementary tool focused on alternative data, not a full financial terminal.

4. What kind of data does AltIndex track?

Social media sentiment, app downloads, website traffic, hiring trends, and more.

5. Who benefits most from AltIndex?

Active traders and data-driven investors who want an edge beyond fundamentals.

Discover More Tools: Interested in exploring more AI tools? Visit our AI Tools Directory for a comprehensive guide to the latest in AI technology across various sectors.

GALLERY

Featured image represents the contents